Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

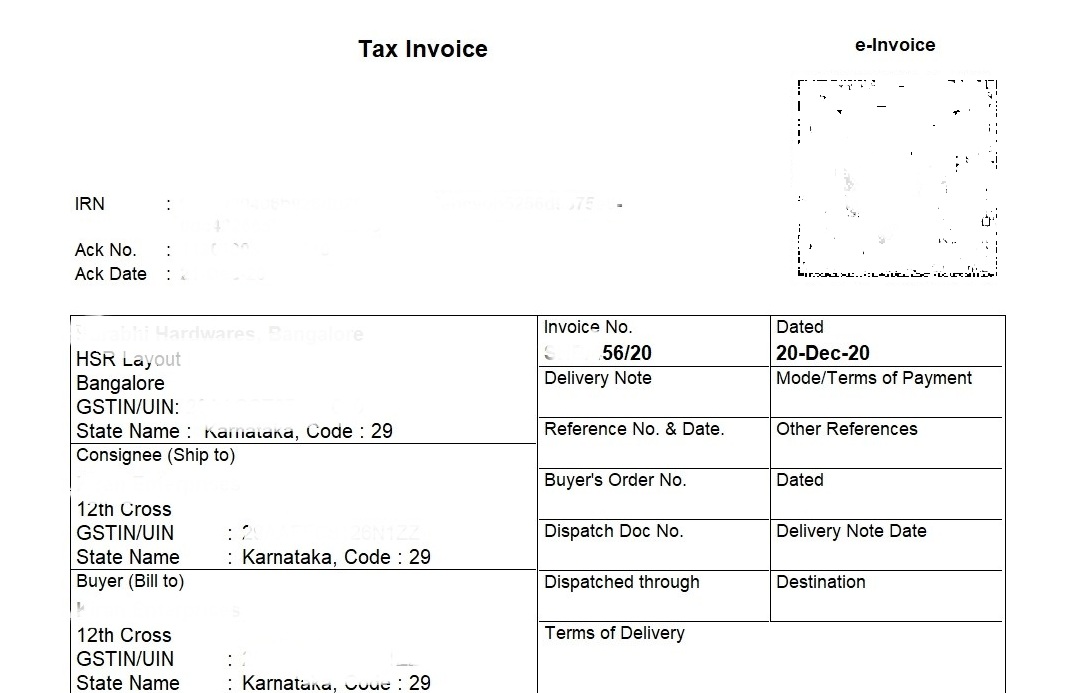

An invoice is a commercial instrument issued by a seller to a buyer. It identifies both the trading parties and lists, describes, and quantifies the items sold, shows the date of shipment and mode of transport, prices and discounts, if any, and delivery and payment terms. In certain cases, (especially when it is signed by the seller or seller’s agent), an invoice serves as a demand for payment and becomes a document of title when paid in full.

Under the GST regime, an “invoice” or “tax invoice” means the tax invoice referred to in section 31 of the CGST Act, 2017. This section mandates issuance of invoice or a bill of supply for every supply of goods or services or both. It is necessary for a person supplying goods or services or both to issue invoice.

Under GST a tax invoice is an important document. It not only evidences supply of goods or services or both, but is also an essential document for the recipient to avail Input Tax Credit (ITC). A registered person cannot avail input tax credit unless he is in possession of a tax invoice or a debit note.

Contents of Invoice:

There is no format prescribed for an invoice, however, Invoice rules makes it mandatory for an invoice to have following fields (only applicable field are to be filled):

(a) Name, address and GSTIN of the supplier;

(b) A consecutive serial number, in one or multiple series, containing alphabets or numerals or special characters hyphen or dash and slash symbolised as “-” and “/” respectively, and any combination thereof, unique for a financial year;

(c) Date of its issue;

(d) Name, address and GSTIN or UIN, if registered, of the recipient;

(e) Name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient is un-registered and where the value of taxable supply is fifty thousand rupees or more;

(f) HSN code of goods or Accounting Code of services;

(g) Description of goods or services;

(h) Quantity in case of goods and unit or Unique Quantity Code thereof;

(i) Total value of supply of goods or services or both;

(j) Taxable value of supply of goods or services or both taking into account discount or abatement, if any;

(k) Rate of tax (central tax, State tax, integrated tax, Union territory tax or cess);

(l) Amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess);

(m) Place of supply along with the name of State, in case of a supply in the course of inter-State trade or commerce;

(n) Address of delivery where the same is different from the place of supply;

(o) Whether the tax is payable on reverse charge basis; and

(p) Signature or digital signature of the supplier or his authorized representative.

Signature or digital signature of the supplier or his authorised representative shall not be required in the case of issuance of an electronic invoice, bill of supply, ticket or any such document in accordance with the provisions of the Information Technology Act, 2000. [The said provision has been inserted vide Notification 74/2018 CT dated 31-12-2018.]

Analysis: In terms with the earlier provision, there was two ways for authenticating the Invoice- (a) Actual signature on the invoice; (b) Digital Signature on the Invoice. With the insertion of the new proviso, the signature or digital signature of the supplier or his authorised representative is not required in the case of issuance of an electronic invoice in accordance with the provisions of the Information Technology Act, 2000 (21 of 2000).”

Electronic Signature has been defined under Section 2(1)(ta) of the Information Technology Act, 2000. Electronic Signature means the authentication of any electronic record by a subscriber by means of the electronic technique as specified under the Second Schedule and also includes a digital signature.

Section 5 of the Information Technology Act, 2000 states that “Where any law provides that information or any other matter shall be authenticated by affixing the signature or any document shall be signed or bear the signature of any person, then, Notwithstanding anything contained in such law, such requirement shall be deemed to have been satisfied, if such information or matter is authenticated by means of [electronic signature]affixed in such manner as may be prescribed by the Central Government”

Section 3A of the Information Technology Act, 2000 – Notwithstanding anything contained in section 3, but subject to the provisions of sub-section (2), a subscriber may authenticate any electronic record by such electronic signature or electronic authentication technique which—

Any electronic signature or electronic authentication technique shall be considered reliable if:

(a) the signature creation data or the authentication data are, within the context in which they are used, linked to the signatory or , as the case may be, the authenticator and of no other person;

(b) the signature creation data or the authentication data were, at the time of signing, under the control of the signatory or, as the case may be, the authenticator and of no other person;

(c) any alteration to the electronic signature made after affixing such signature is detectable

(d) any alteration to the information made after its authentication by electronic signature is detectable; and

(e) it fulfills such other conditions which may be prescribed

Section 14 of the Information Technology Act, 2000 states that Where any security procedure has been applied to an electronic record at a specific point of time, then such record shall he deemed to be a secure electronic record from such point of time to the time of verification.

Section 15 of the Information Technology Act, 2000 define Secure electronic signature—An electronic signature shall be deemed to be a secure electronic signature if— (i) the signature creation data, at the time of affixing signature, was under the exclusive control of signatory and no other person; and (ii) the signature creation data was stored and affixed in such exclusive manner as may be prescribed.

Explanation.–In case of digital signature, the ―signature creation data means the private key of the subscriber.

Hence, with the proviso inserted by above Notification, the actual signature or digital signature of the supplier is not required. In terms with the Information Technology Act, the electronic record shall be authenticated by any reliable technique (Security procedure to be followed) so as to make it a secure document and ensure that the electronic record cannot be tampered with. Therefore, Input tax credit can be availed on the basis of Tax invoice not actually signed or digitally signed but containing remarks as ” Computer generated invoice and require no signature”

NOTE: SO WE PREFER EITHER ORIGINAL SIGNED (PAPER MODE) INVOICE OR DIGITALLY SIGNED INVOICES, OR THE INVOICE SHALL BE AUTHENTICATED BY ANY RELIABLE TECHNIQUE (SECURITY PROCEDURE TO BE FOLLOWED).